Sep ira calculator

Like all retirement savings programs though there are limits rules and regulations you need to know about to get the most out of your savings. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

7 Common Traditional Ira Rules Inside Your Ira Traditional Ira Ira Investing For Retirement

Find an Advisor.

. IRA Contribution Calculator Choosing the right retirement account can be complicatedbut it doesnt necessarily have to be. It can be a useful tool for saving for retirement. As an example for a sole proprietor April 18 would be the deadline to establish and fund a SEP for the prior tax year.

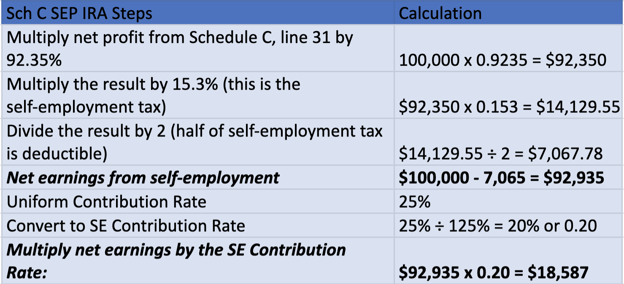

Employer contributions are limited to the lesser of 61000 for 2022 58000 for 2021 or 25 of eligible compensation 20 of self-employed net earnings. A Simplified Employee Pension IRA or SEP IRA allows self-employed people and small-business owners to save up to 61000 in 2022 for retirement. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

The ira calculator exactly as you see it above is 100 free for you to use. Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from TD Ameritrade. Employers must fill out and retain Form 5305 SEP PDF in their records.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Therefore it is a generous retirement plan and employee benefit but expensive for employers. Beginning in 2020 IRA owners can withdraw up to 5000 without penalty following the birth or adoption of a child.

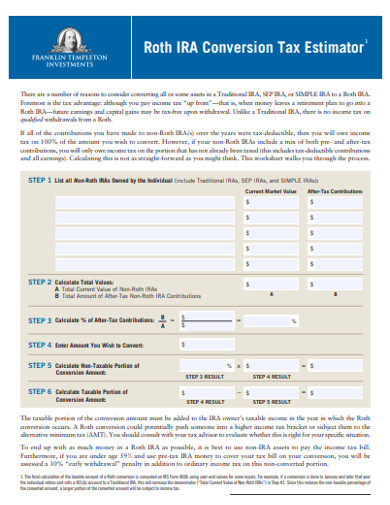

Roth Conversion Calculator Methodology General Context. While a good financial advisor can help you navigate the finer points of. If you had a transfer or rollover to your Schwab retirement accounts a conversion from a traditional IRA to a Roth IRA and back or any correction for security price after year-end please call us at 877-298-8010 so we can recalculate your RMD.

You can contribute up to 25 of your earned income to a SEP IRA with a maximum of 58000 per year as of 2021. Your household income location filing status and number of personal exemptions. Budgeting Calculator Financial Planning Managing Your Debt Best Budgeting Apps Investing.

As with other retirement plans the SEP IRA allows withdrawals at age 59 ½ and requires distributions at age 72 70 ½ if you reach 70 ½ before January 1 2020. Since you are not self-employed you do not need to be using TurboTax Self Employed. The SEP-IRA limit in 2022 is 25 of an employees salary or up to 61000 whichever is less.

No plan tax filings with IRS. Employee notification of employers contribution. If you return the cash to your IRA within 3 years you will not owe the tax payment.

SEP IRA contributions are made by the employer and the contributions are vested immediately. With a SEP IRA employees can enjoy tax-deferred growth until retirement on any deposits. Contributions to an IRA.

Print and complete the adoption agreementRetain a copy and return the signed original to Schwab. All contributions made to a SEP are employer contributions. A SEP IRA can be useful for deferring income saving for retirement and saving money on taxes.

SEP-IRA Contribution Limits and Deadlines. 56000 for 2019 and 55000 for 2018 or 25 of the employees compensation. With the possible exception of Traditional SEP and SIMPLE IRA owners who pass away on or after the required beginning date it seems reasonable to assume the IRS will interpret the 10-Year.

The contribution to your SEP IRA must be made by the S corp and is deductible on the S corps tax return not your individual tax return. Parents of newborns recently became eligible to take penalty-free IRA distributions. Footnote 1 You also have the opportunity to contribute nearly 10 times more to a SEP IRA than a Traditional IRA.

401K and other retirement plans. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRAs ie traditional rollover SEP andor SIMPLE IRAs into a Roth IRA but it is intended solely for educational purposes it is not designed to provide tax advice and. SEP IRAs SEP stands for Simplified Employee Pension plan and applies to employers not limited by number of employees.

The employee is immediately 100 percent vested in all SEP IRA contributions and has full control of the money. IRA is an account with tax features that help individuals save for retirement expenses. Call us at 800-435-4000.

A SEP IRA must be established and funded by the corporate tax filing deadline generally March 15th or September 15 if an extension was filed. Consider a defined benefit plan as an alternative to a SEP IRA if you would like to contribute more than the 2022 SEP IRA limit of 61000. A SEP Simplified Employee Pension IRA is a form of IRA designed to help small business owners and their employees save for retirement.

Contributions to a defined benefit plan are dependent on an individuals age and income but can potentially be 100000 to 200000 or more a year. For comparison purposes Roth IRA and regular taxable savings will be converted to after-tax values. A SEP-IRA is a tax-deferred retirement plan for self-employed people and small business owners.

Follow these instructions for establishing and contributing to a SEP-IRA plan. Small Business Retirement Calculator. The SIMPLE IRA contribution limit is 14000 for 2022 with a catch-up contribution limit of 3000.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. To calculate Roth IRA with after-tax inputs please use our Roth IRA Calculator. TurboTax Premier is sufficient.

The contribution limits of a SIMPLE IRA vs. What are the contribution limits for a SEP IRA. A Simplified Employee Pension SEP IRA is a retirement plan that allows for higher tax-deductible contributions tax-deferred growth hassle-free account maintenance and a flexible contribution schedule making it a good choice for small business owners and self-employed individuals.

However when the employees are the children the money stays in the family and the parents are helping their children prepare for retirement and the. Review the basic plan document which describes and governs your account and keep it for your records. SEP-IRA are different too.

When may the funds be withdrawn. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. You must contribute the same percentage of income for eligible employees as you do for yourself.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Information You Need About When You Can Tap Your 401k Money. Our IRA Contribution Calculator will take you through what you need to know to make an informed decision.

The rules for rolling over or transferring funds are the same as for a traditional IRAYou generally can move funds to or from a SEP IRA into or from a traditional IRA or other pre-tax retirement plan like a 401k or 403b without incurring. The maximum your S corp can contribute to your SEP IRA is 25 of your W-2 compensation. Each employee must open an individual SEP IRA account.

Internal Revenue Code Sections 402h and 415 limit the amount of contributions made to an employees SEP-IRA to the lesser of dollar limitation for the year 61000 for 2022 58000 for 2021. Input your information below and see how much you can contribute to a Traditional Roth and SEP IRA account this.

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining Bitcoin What Is Bitcoin Mining

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Simple Ira Retirement Plan For Small Business Owners Simple Ira Retirement Planning Ira Retirement

Roth Ira Calculators

Financial Planning Spreadsheet Financialplanningspreadsheet Personal Financial Planning Financial Planning Financial Plan Template

What Are Roth Ira Accounts Nerdwallet Roth Ira Individual Retirement Account Ira Investment

New 2023 Irs Retirement Plan Contribution Limits Including 401 K Ira White Coat Investor

Choosing A Small Business Retirement Plan From A Tax Perspective

5 Roth Ira Calculator Templates In Pdf Free Premium Templates

Self Employed Here Are 5 Retirement Savings Options For You The Motley Fool Saving For Retirement Investing For Retirement The Motley Fool

How To Calculate Sep Ira Contributions For An S Corporation Youtube

Sep Ira The Best Self Employed Retirement Account

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

Don T Waste Your Time With A Sep Ira Emparion

Pin On All About Saving Money

Compound Interest Calculator Investor Gov Interest Calculator Compound Interest Calculator

Retirement Calculator Spreadsheet Dividend Income Dividend Retirement Calculator